In Q2 2024, FMCG brands ramped up product launches across categories like biscuits, ice cream, and snacks. This article explores the strategies and timing behind these introductions, highlighting market trends and competition.

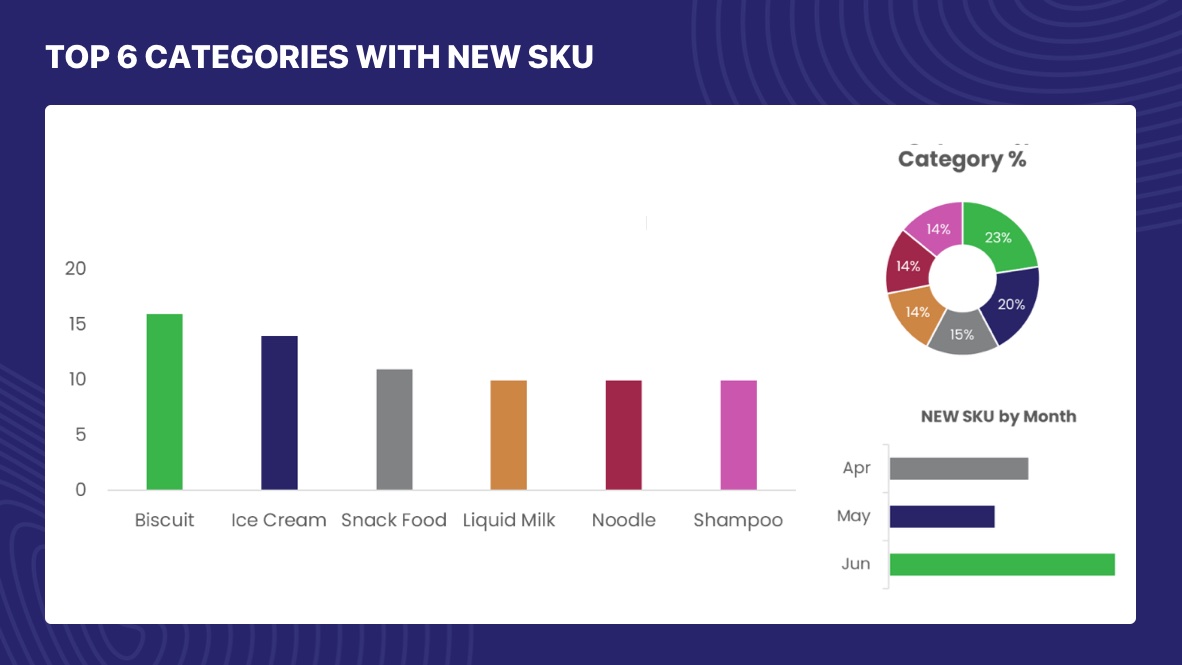

The second quarter of 2024 saw a dynamic wave of new product introductions across various categories. Biscuits led the way with 16 new SKUs, mainly driven by brands like Universal Robina Munchy's (Munchy’s) and Mondelez (Chipsmore), peaking in June with 10 launches, signalling a strategic push. Ice Cream followed closely, with 14 new SKUs from Nestle, General Mills, and Unilever, primarily introduced in June, likely aligning with seasonal demand. Snack Food also saw significant activity, particularly in the Salty Snacks subcategory, driven by brands like Wise and Jack 'n Jill. Additionally, Liquid Milk, Noodles, and Shampoo categories highlighted varied and targeted strategies across these segments.

Source: MailerTrack

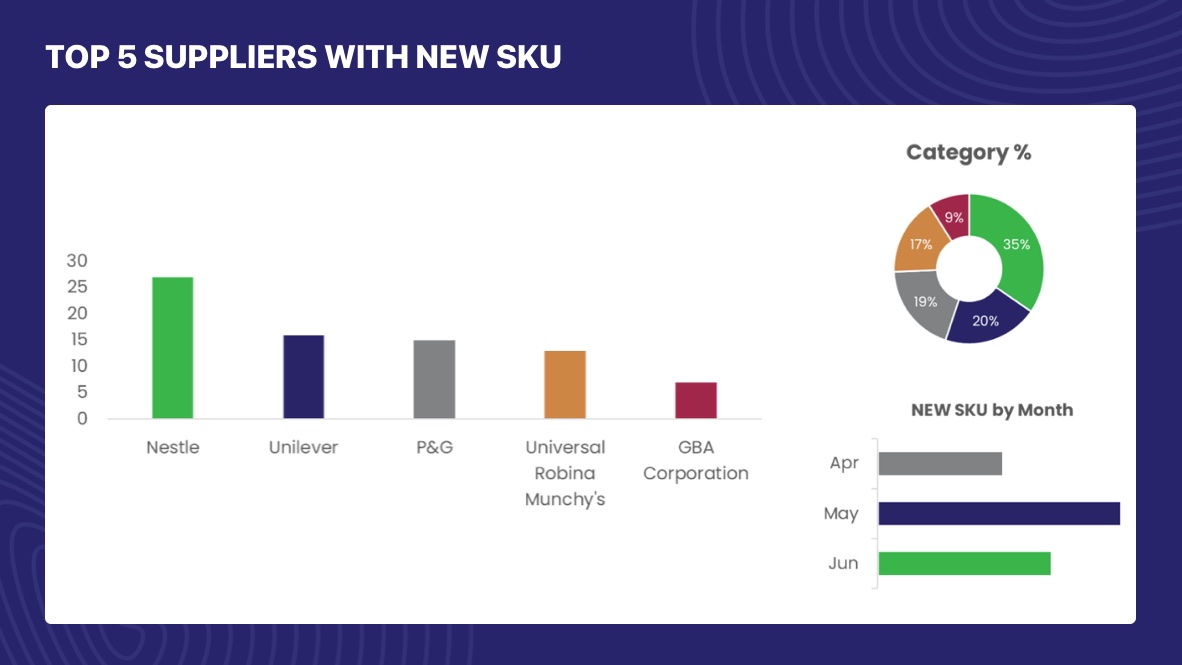

Source: MailerTrackOn the supplier side, we observed distinct patterns in product launches. Nestlé's aggressive early-quarter rollouts, signaling a strategic push to capture early market trends, intensified the competitive landscape. Unilever focused its efforts in May and June, possibly aligning with key promotional events. P&G maintained a steady pace, particularly strong in April and May, likely testing consumer responses before wider rollouts. Universal Robina Munchy’s SKU distribution reflects a strategy of consistent market engagement, while GBA Corporation’s late-quarter focus may indicate strategic timing to tap into specific market opportunities.

Source: MailerTrack

Source: MailerTrackThese insights underline the importance of timing, category focus, and tailored strategies in successfully launching new products. The varied approaches of top suppliers, such as Nestlé's early-quarter rollouts and GBA Corporation's late-quarter focus, reflect the industry's adaptability to meet evolving consumer demands, providing reassurance about its resilience.