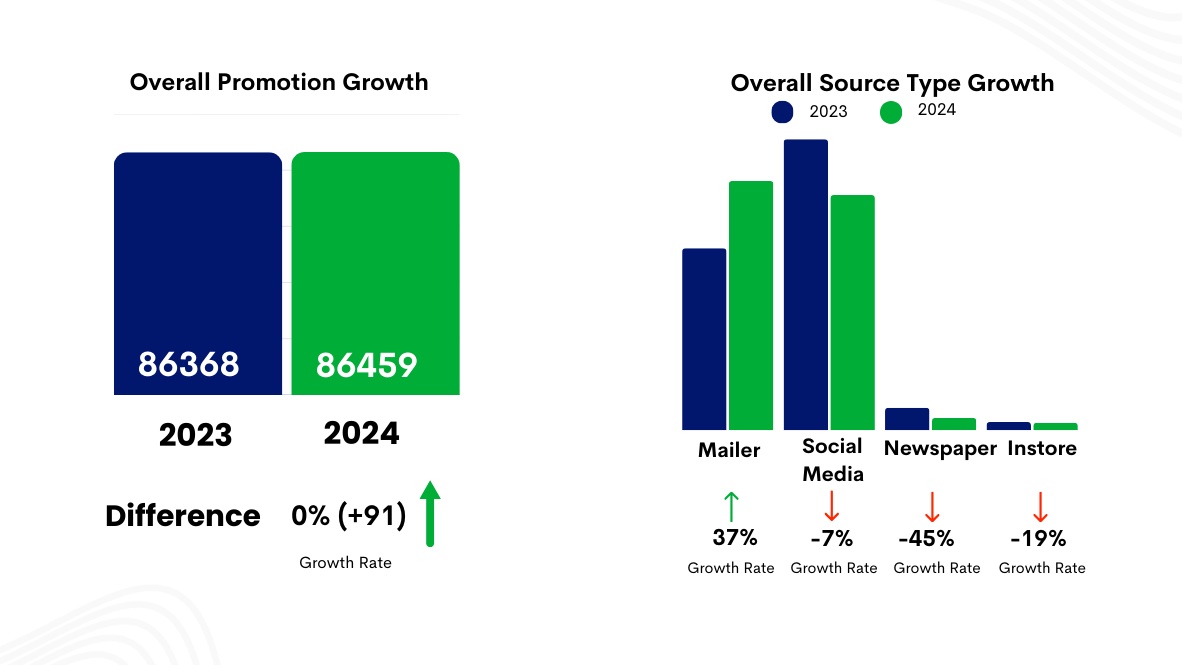

As we evaluate the first quarter of 2024, the promotional landscape in Malaysia's retail sector saw a modest increase of 19 features.

Here's a snapshot of the evolving strategies and performance across various retail formats:

Source: MailerTrack

Source: MailerTrackEnhanced Focus on Mailer Promotions

This quarter saw a modest overall increase in promotional activities, highlighted by a notable 37% rise in mailer promotions, which include both digital and traditional mailer. This uptick suggests that retailers are amplifying their direct marketing efforts to engage consumers more effectively.

Source: MailerTrack

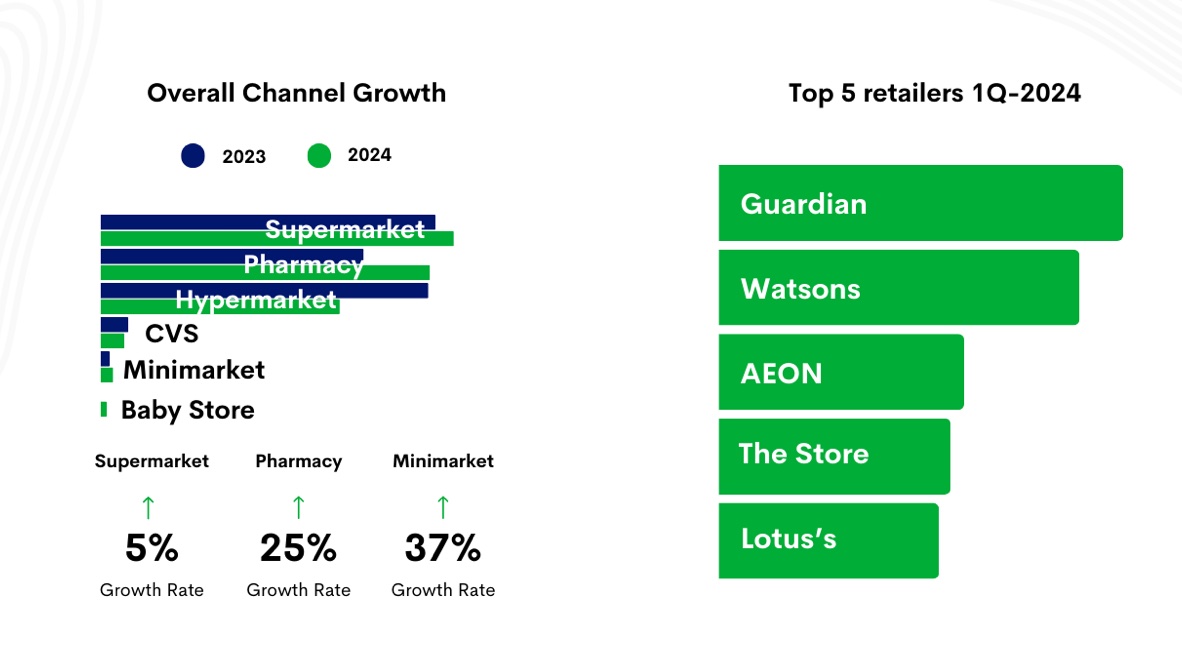

Source: MailerTrackVaried Performance Across Retail Channels

Supermarkets, MiniMarts, and Pharmacies have experienced positive growth, led by retailers like Guardian, Watsons, Sunway, Segi Fresh, and Billion, each adding over 800 promotional features compared to last year. On the flip side, Giant faced a steep decline, shedding over 4,500 promotional features, indicating potential shifts in marketing focus or consumer engagement challenges.

Channels Insights

The convenience store segment saw mixed results. While convenience stores such as 7-Eleven, myNEWS, and Family Mart saw a decline in promotional activities, petrol stations (excluding Caltex) recorded an increase, especially during the festive season as people travel and return to their hometowns, demonstrating strategic adjustments to consumer mobility patterns.

Minimarts Adaptation

Conversely, the growth in minimarts, driven by 99sm and KK Mart, signals a rising consumer preference for these more accessible retail formats.

Source: MailerTrack

Source: MailerTrackSeasonal Influences on Product Categories

In the grocery sector, beer promotions surged, mainly due to the Chinese New Year celebrations, highlighting the impact of seasonal trends on promotional strategies. Other festive drink categories like Asian drinks and carbonated soft drinks saw a reduction compared to 2023, except for isotonic drinks, which showed a slight increase

Health & Beauty Promotional Adjustments

The Health & Beauty's categories mostly saw increased promotions, except for personal wash, baby diapers, and eye care, which experienced reductions exceeding 100 features, potentially due to market saturation or a shift in consumer demand.

Household Promotions Reflect Festive Demand

Facial tissues saw the most substantial increase in the household department, driven by promotions featuring festive designs, suggesting that retailers are capitalising on seasonal demand fluctuations to attract consumers.

Narrow Focus in Chilled and Frozen Categories

Within the chilled and frozen department, pasteurised milk was the standout category with an increase in promotions. This was mainly due to most brands increasing their promotional activities and new players starting to promote in this category compared to 1Q 2023

Conclusion

The 1Q 2024 promotional data provides crucial insights for retailers and suppliers, underscoring the importance of continuously adapting promotional strategies to align with consumer trends and market conditions. Understanding and responding to these shifts will be key to maintaining relevance and enhancing consumer engagement in Malaysia’s competitive retail market.