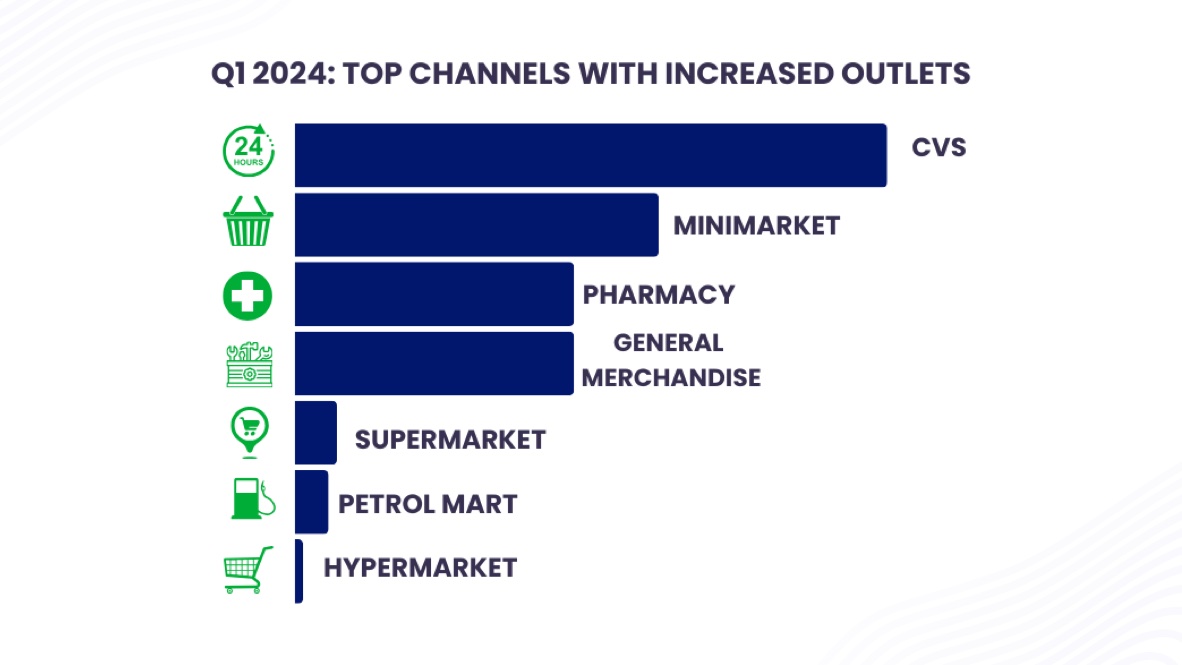

Analysing Q1 2024 and the Malaysian retail market has revealed not only the rapid growth of meaningful number of outlet openings through different channels but also a movement towards invaluable accessibility and consumer reach.

Source: Intrack

Source: IntrackChannel Expansion Highlights:

In no small measure, convenience stores are a leading source of this expansion as shown by 56 additional outlets for 7-Eleven implying that consumers want to buy goods while on the move. Quick shopping experiences are largely preferred in minimart channel since they have resulted into new 36 outlets for 99SM. Mr. DIY in general merchandise industry gained larger ground by opening more stores which were 33, thereby indicating the rising demand for home improvement and DIY supplies from customers.

Pharmacy Channel Growth:

Pharmacy channel also saw the most significant increase among pharmacies, likely in response to heightened health consciousness among consumers. Meanwhile, Big Pharmacy, although opening only three new outlets, has introduced a new feature in their app called e-Dietician, designed to assist with meal planning and nutrition, highlighting ongoing innovation within the sector. Other pharmacies also recorded increases, reflecting a general growth trend in the health and wellness industry.

Source: Intrack

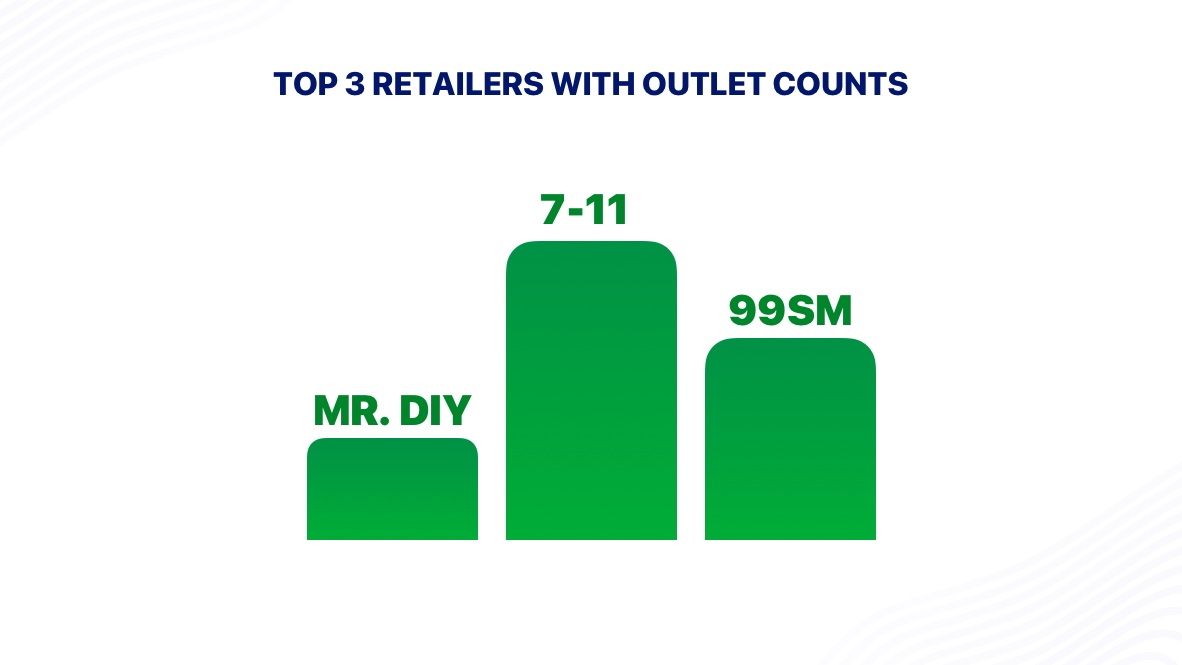

Source: IntrackLeading Retailers by Outlet Numbers:

The dominance of 7-Eleven and 99SM is apparent with their substantial outlet counts, affirming their strong positions in the market. Mr. DIY's considerable number of new outlets signifies the brand's solid strategy in catering to the practical needs of consumers.

Insightful Implications:

This notable increase in retail outlets signals a competitive, yet promising market landscape. The strategic placement of new stores by leading retailers indicates not just expansion but a deeper understanding of consumer purchasing patterns and local demand.

Strategic Insights for Businesses:

For businesses and suppliers, these patterns suggest ample opportunities to forge partnerships with these expanding networks. Identifying the right channels and adapting distribution strategies will be essential to capitalise on this growth. There is a clear message for retailers to continue focusing on convenience and diversification of products to maintain this upward trajectory.

Concluding Thoughts:

The Q1 expansion reflects a robust retail environment in Malaysia, where adaptability and strategic alliances will be key to harnessing the full potential of the market’s growth.

Disclaimer: This information is based on Intrack’s retailer data from 15th Jan 24 to 1st Apr 24